[Q&A] Customs Tax violations and Exception from Penalties

2023. 3. 27

[Q&A] Customs Tax violations and Exception from Penalties

As a corporate law firm, we are used to answering many questions from our clients about their business in China. In this series of Q&A articles, we will discuss some of the topics that our clients have shown interest in.

Question: How can I deal with customs tax violations, and can I be exempt from penalties?

Answer: The recently revised 2021 Administrative Penalty Law clarifies that "an administrative penalty shall not be imposed if the violation is minor and timely corrected and no harmful consequences are caused" and "an administrative penalty may not be imposed if the first violation of the law is minor and harmful consequences are made timely". In practice, however, it is common for companies to fail to fully evaluate their actions, resulting in a customs inspection and subsequent penalty. In order to be exempt from penalties, companies can use the disclosure system.

In this regard, on June 30, 2022, the General Administration of Customs issued Announcement No. 54 of 2022, "Announcement on the Consideration of Voluntary Disclosure of Tax Violations," which will take effect on December 31, 2023.

This document contains clear and updated provisions on the application of proactive disclosure of tax-related violations.

Namely, the tax violation refers to acts that affect tax collection and management in violation of customs supervision regulations, such as tax omission, tax underpayment, and acts that affect the management of state export rebates.

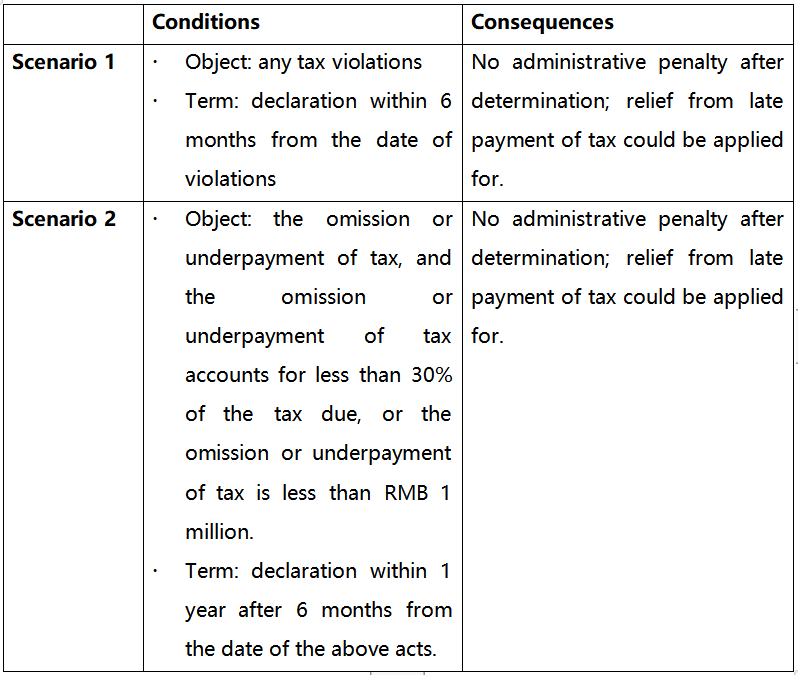

Furthermore, the companies shall understand that voluntary disclosure and exemption from penalties will only apply to the following scenarios:

However, there are also exceptions to the application of the aforementioned provisions:

1. In the case of repeated proactive disclosure of the same tax-related violation.

2. If Customs already had knowledge of the violation prior to the disclosure.

3. If Customs has notified the reporting entity of the audit prior to the report.

4. If the content of the report is grossly inaccurate or if other violations are concealed.

The proactive disclosure process consists of filling out the proactive disclosure report form, attaching accounting reports, documents, and other materials, and reporting to the customs authorities at the place of customs declaration, actual import and export, or at the place of registration through the customs website.

Thus, the system of active disclosure of customs information under the new rules is a preferential policy that avoids subsequent penalties due to tax violations.

Question: How can I deal with customs tax violations, and can I be exempt from penalties?

Answer: The recently revised 2021 Administrative Penalty Law clarifies that "an administrative penalty shall not be imposed if the violation is minor and timely corrected and no harmful consequences are caused" and "an administrative penalty may not be imposed if the first violation of the law is minor and harmful consequences are made timely". In practice, however, it is common for companies to fail to fully evaluate their actions, resulting in a customs inspection and subsequent penalty. In order to be exempt from penalties, companies can use the disclosure system.

In this regard, on June 30, 2022, the General Administration of Customs issued Announcement No. 54 of 2022, "Announcement on the Consideration of Voluntary Disclosure of Tax Violations," which will take effect on December 31, 2023.

This document contains clear and updated provisions on the application of proactive disclosure of tax-related violations.

Namely, the tax violation refers to acts that affect tax collection and management in violation of customs supervision regulations, such as tax omission, tax underpayment, and acts that affect the management of state export rebates.

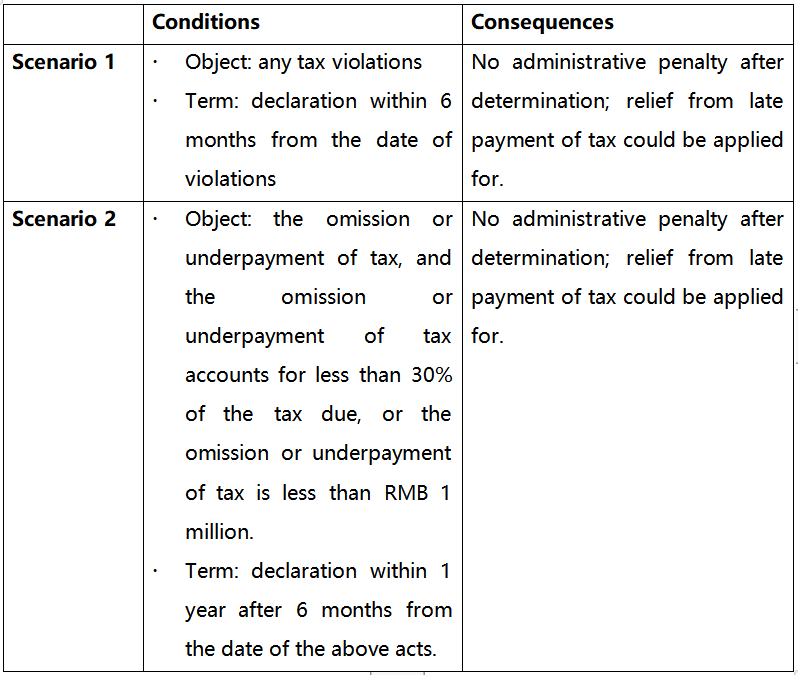

Furthermore, the companies shall understand that voluntary disclosure and exemption from penalties will only apply to the following scenarios:

However, there are also exceptions to the application of the aforementioned provisions:

1. In the case of repeated proactive disclosure of the same tax-related violation.

2. If Customs already had knowledge of the violation prior to the disclosure.

3. If Customs has notified the reporting entity of the audit prior to the report.

4. If the content of the report is grossly inaccurate or if other violations are concealed.

The proactive disclosure process consists of filling out the proactive disclosure report form, attaching accounting reports, documents, and other materials, and reporting to the customs authorities at the place of customs declaration, actual import and export, or at the place of registration through the customs website.

Thus, the system of active disclosure of customs information under the new rules is a preferential policy that avoids subsequent penalties due to tax violations.